Navigating the Basics of Binary Options Trading for Beginners

August 27th, 2024

00:00

00:00

Summary

- Introduction to binary options trading for novices

- Key components and mechanics of binary options explained

- Overview of different binary options types

- Legal considerations for binary options trading globally

Sources

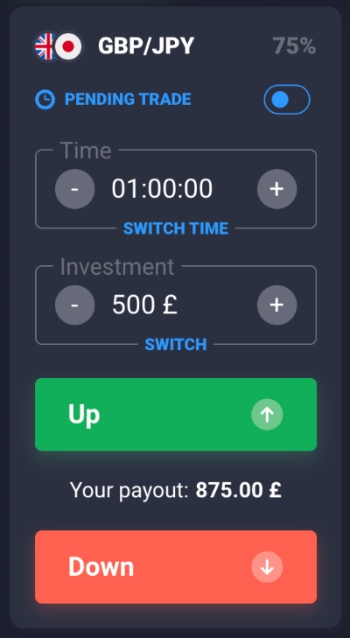

In the realm of finance, binary options trading has emerged as an accessible avenue for individuals to engage in market speculation. This form of trading centers around a fundamental question: will the price of an asset be above or below a predetermined level at a specified time? Binary options, a category of derivatives, do not involve the ownership of the underlying asset. Instead, they offer a way to bet on price movements. A correct prediction yields a fixed payout, often a proportion of the initial investment, while an incorrect one results in the loss of the stake. The allure of binary options lies in their simplicity. Traders can engage with a variety of underlying assets, including stocks, foreign exchange, commodities, and even cryptocurrencies. The duration of these contracts can range from mere seconds to days or weeks, catering to the preferences of short-term traders. However, the simplicity of binary options does not negate the need for a well-thought-out trading strategy and prudent risk management. These elements are crucial for a rewarding experience in binary options trading. Turning to broker selection, its essential to choose a reputable platform. The top binary options brokers, according to recent evaluations, include Pocket Option, IQCent, CloseOption, and Videforex. These platforms provide diverse assets for trading and various contract lengths to suit different trading styles. When initiating a trade, several key components must be considered: the asset in question, the expiry time of the contract, the stake amount, the potential payout, and the strike price. These factors collectively determine the structure of a binary options contract. A variety of option types are available to traders. Up/Down options are the most straightforward, asking whether the price will be higher or lower than the current price at expiry. In/Out options involve deciding if the price will remain within a set range, while Touch/No Touch options are concerned with whether the price will reach a certain level before expiration. Ladder options, which require a significant price move, offer payouts that can exceed 100%. The legal landscape for binary options trading varies by region. While legal in many parts of the world, traders should ensure they use a reputable, regulated broker. The binary options market has faced scrutiny over fraudulent activities by some brokers, so caution and thorough research are paramount. Comparing binary options to another popular trading instrument, contracts for difference (CFDs), reveals distinct differences. CFDs carry potentially unlimited risk, with profits and losses varying with the assets price movement. In contrast, binary options offer a fixed risk and reward, giving traders a clear understanding of their potential gain or loss before entering a trade. The advantages of binary options include their simplicity, fixed risk, trade control, and the potential for high returns. The disadvantages include reduced trading odds for high-payout trades, limited trading tools, the high cost of losing trades, and minimum investment requirements that can be higher than in other markets. For those ready to begin trading binary options, the process comprises several steps: selecting a broker, choosing a market, deciding on an expiry time, determining the trade size, and choosing an option type. Practice with demo accounts can be invaluable, allowing traders to experiment without risking real money. In developing a trading strategy, two critical elements are creating a signal and deciding how much to trade. Charts, patterns, indicators, and news events can all provide signals, while a sensible approach to money management is necessary to determine trade sizes. Strategies like the Martingale, percentage-based, and straddle strategies cater to different risk tolerances and trading styles. For those seeking to automate their trading strategy, bots and algorithmic trading can be utilized, though its crucial to remain engaged and vigilant in monitoring these systems. Timing is also an essential factor, with different strategies benefiting from varying expiry times. Education is a cornerstone of successful trading. Resources such as books, video tutorials, online courses, and forums can provide a wealth of knowledge and facilitate continuous learning. Traders should also keep abreast of market news and trends for informed decision-making. In conclusion, while binary options trading presents an opportunity for profit, it requires knowledge, strategy, and risk awareness. Traders must exercise caution and educate themselves thoroughly to navigate the risks and potentials of this financial instrument effectively. Binary options, as a financial derivative, allow traders to speculate on the direction of an underlying assets price movement without the necessity of owning the asset itself. This form of trading can be conducted across a variety of markets, offering a versatility that appeals to a broad spectrum of investors. Delving into the mechanics of a binary options trade, one must comprehend its key components. Central to a binary contract is the asset itself, which could be a stock, a currency pair, a commodity, or even a cryptocurrency. The expiry time is the predefined duration after which the option will conclude, and can range from seconds to months. The stake is the amount the trader invests, and it represents the total capital at risk. The payout is a fixed amount that the trader stands to gain if the prediction is correct, typically expressed as a percentage of the stake. Lastly, the strike price is the assets price level that the trader predicts the asset will be above or below at the expiry time. Binary options come in various forms, allowing traders to choose an option type that aligns with their market outlook and risk appetite. Up/Down options, also known as High/Low, are the simplest and most common type, where one predicts whether the assets price at expiry will be higher or lower than the current price. In/Out options, or Range/Boundary options, require traders to predict whether the price will remain within or exit a predefined range. Touch/No Touch options revolve around whether the asset will reach a specific price level before expiry. Ladder options, which are more complex, involve several price levels that the asset must reach to result in payouts that can often surpass 100%. The legality of trading binary options varies by region. While it is a legitimate form of trading, it has attracted negative attention due to fraudulent activities by unscrupulous brokers. Consequently, regulation is a critical aspect to consider. In some regions, like the European Union, retail traders are barred from trading binary options, while professional traders may still have access. Other regions, such as India and Australia, permit binary options trading, provided that traders engage with regulated brokers. The regulatory environment aims to protect traders by ensuring that only reputable brokers operate in the market. For example, Nadex is a regulated exchange in the United States where traders can legally trade a variety of binary options. Traders must remain vigilant, avoiding platforms that promise unrealistic returns or that lack proper regulatory oversight. In the next segment, the focus will shift to technical analysis as a tool for making informed decisions in binary options trading. Technical analysis involves analyzing historical price movements and other market data to forecast future price behavior, which is particularly relevant for binary options traders given the short-term nature of many binary options contracts.