How Are Companies Monetizing AI Features Today?

August 1st, 2024

00:00

00:00

Summary

- Overview of AI technology integration and monetization challenges

- Discussion on direct vs. indirect AI monetization strategies

- Analysis of pricing and bundling strategies in tech companies

- Strategic framework for AI monetization decision-making

Sources

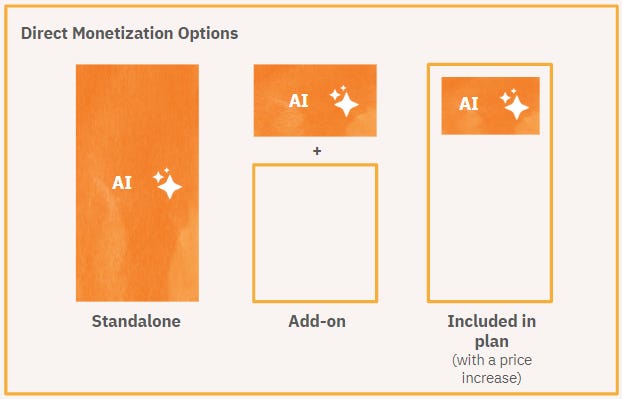

The rapid evolution of artificial intelligence technology is reshaping the landscape of digital products and services. As companies strive to integrate AI into their offerings, they face a complex challenge: how to effectively monetize these advanced features. This transformation is not just about harnessing AI for its powerful capabilities but also about developing innovative monetization strategies that address both the unique costs associated with AI and the competitive pressures of the market. Artificial intelligence, particularly generative AI, introduces significant underlying costs that differ from traditional software as a service, or SaaS, products. These costs encompass compute power, data storage, and more, necessitating a strategic approach to pricing and monetization. The intense competition in the AI space further complicates this scenario, pushing companies to think creatively about how to derive value from their AI investments. In response, companies are exploring various monetization strategies, predominantly focusing on direct and indirect methods. Direct monetization often involves charging users specifically for AI features or increasing the overall product price upon integrating AI. Indirect monetization, on the other hand, might include bundling AI features into existing packages without altering the price, thereby enhancing the products value and appeal without immediate additional charges to the customer. The choice between these strategies can significantly impact a companys ability to recover AI investments and achieve sustainable growth. The decision largely depends on several factors, including the perceived value of the AI feature to the customer, the competitive landscape, and the specific costs associated with AI functionality. Moreover, the approach to monetizing AI is influenced by broader market dynamics and investor expectations. For instance, significant shifts in investor focus from mere adoption to concrete return on investment for AI technologies have been noted during financial discussions like Alphabet’s second-quarter earnings call in twenty twenty-four. These shifts underscore the importance of not only adopting AI but also strategically monetizing it to satisfy both market and investor expectations. As this technology continues to evolve, companies must remain agile, constantly adapting their strategies to balance innovation with profitability. This involves not only understanding the direct costs associated with AI but also leveraging AI to create compelling, valuable products that users are willing to pay for. The ongoing challenge for businesses is to navigate this complex terrain effectively, ensuring that their AI features are not just technologically advanced but also economically viable. Building on the foundational understanding of the evolving AI landscape, it is crucial to delve into the specific monetization challenges that artificial intelligence presents as compared to traditional software as a service products. The integration of AI into products not only involves complex technological enhancements but also introduces unique economic and strategic challenges, primarily due to the significant underlying costs and intense market competition. Generative AI, a key area of focus, requires substantial computational power. This not only involves high initial costs for infrastructure but also ongoing expenses related to data processing, storage, and sophisticated algorithms that need continuous updates and maintenance. These costs are vastly different from those associated with traditional SaaS products, where the primary expenses often involve server space and software maintenance, which generally do not scale as steeply with increased usage. Moreover, the competitive pressures in the AI market add another layer of complexity to monetization strategies. As AI technology becomes more central to product offerings across various industries, companies find themselves in a race not only to develop but also to effectively monetize AI features. This competition drives the need for innovative pricing strategies that can accommodate the high costs of AI development while still attracting and retaining customers. A notable shift in the landscape is how investors are evaluating AI ventures. For instance, during Alphabet’s second-quarter earnings call in twenty twenty-four, there was a pronounced pivot in investor inquiries, focusing heavily on the return on investment of the twelve billion dollar AI initiatives. This shift marks a significant change from previous quarters where the emphasis might have been more on the adoption and technological advancement of AI. Investors are increasingly scrutinizing the financial viability and ROI of AI projects, pushing companies to demonstrate not just technological prowess but also economic benefits. This heightened focus on ROI has implications for how companies approach the development and introduction of AI features. Its no longer sufficient to implement AI for its technological benefits alone. Companies must now craft strategies that not only cover the substantial costs of AI but also generate measurable financial returns. This may involve rethinking pricing models, considering both direct and indirect monetization approaches, and possibly integrating AI features in ways that enhance existing products without necessitating steep price increases. The challenge, therefore, lies in balancing innovation with practical monetization strategies, ensuring that AI features are not only advanced and useful but also contribute positively to the company’s bottom line. As the AI landscape continues to evolve, the ability to adapt monetization strategies in response to technological advancements and market dynamics will be crucial for sustained success and profitability in the AI domain. Navigating the complexities of AI monetization requires a strategic approach, where companies typically choose between two primary methods: direct and indirect monetization. Each strategy offers distinct advantages and challenges, and the choice largely depends on a companys specific circumstances, including the nature of the AI technology, market dynamics, and customer expectations. Direct monetization involves explicitly charging for AI features. This could be through adding a premium price to products that incorporate AI technologies or by offering AI enhancements as paid add-ons. This approach allows companies to directly recoup the investments made in AI development and infrastructure. It also simplifies the measurement of return on investment since the revenue generated can be directly attributed to specific AI features. For instance, a company like GitHub employs a direct monetization strategy with its AI-powered tool, Copilot, which suggests code snippets to developers. GitHub offers Copilot as a paid add-on, which directly generates revenue and provides clear metrics on user adoption and willingness to pay for such AI enhancements. Conversely, indirect monetization involves integrating AI features into existing products or services without directly charging additional fees. This strategy can enhance the core offerings and increase the overall value of the product, potentially leading to higher user retention, greater user satisfaction, and indirectly boosting revenue through increased sales volumes or subscription renewals. A prime example of indirect monetization is seen with companies like Spotify. By integrating AI-driven personalized playlists, such as Discover Weekly, Spotify enhances user engagement and satisfaction, which contributes to higher retention rates and indirectly drives revenue through sustained or upgraded subscriptions, even though the AI feature itself is not directly sold. Each monetization strategy comes with its own set of challenges. Direct monetization, while providing a clear path to profitability, might limit the adoption of AI features if customers are not willing or able to pay additional fees. This strategy requires careful consideration of customer value perception and competitive pricing strategies. Indirect monetization, while potentially enhancing product appeal and customer satisfaction, makes it difficult to directly measure the financial impact of AI features. It also requires a deep understanding of how these enhancements contribute to broader business metrics like customer retention or acquisition. In choosing between direct and indirect monetization, companies must consider their specific AI capabilities, market position, and business goals. The decision should align with the companys overall strategy for product development and customer engagement, ensuring that AI features are not only technologically effective but also economically beneficial. By examining real-world applications and continuously adapting to market feedback and financial performance, companies can effectively leverage AI to enhance their products and achieve sustainable profitability. As companies refine their strategies for monetizing AI, a deeper analysis of current trends reveals insightful patterns in how AI is integrated into pricing models. This insight is particularly evident among forty-four leading tech incumbents who are at the forefront of AI technology adoption and monetization. These companies illustrate a diverse range of approaches, primarily focusing on bundling AI features into existing packages and, increasingly, offering AI features as standalone products. A predominant trend among these incumbents is the integration of AI features into existing product packages. This approach allows companies to enhance the overall value of their core offerings without necessitating a separate purchase or subscription. For example, enterprise software providers are increasingly embedding AI-driven analytics and automation tools into their standard software suites at no additional cost. This strategy not only improves product functionality but also encourages user adoption and retention by continuously adding value to the existing user bases subscriptions. Microsoft, for instance, integrates AI features such as predictive text and automated data analysis into its Office 365 suite. By enhancing the existing features with AI, Microsoft can offer a more compelling product without altering the basic cost structure for the end user. This integration helps in maintaining competitive advantage and customer loyalty, as users gain access to sophisticated AI tools within a familiar framework. Conversely, there is a growing trend towards offering AI features as standalone products. This approach is particularly prevalent among companies that develop highly specialized AI technologies which provide distinct value on their own. Standalone AI products allow companies to target specific market segments that require advanced AI capabilities beyond what general software suites provide. OpenAIs GPT technology, for example, has been packaged into various standalone products that cater to different needs, such as ChatGPT for conversational applications and DALL-E for image generation. These products are priced separately, enabling OpenAI to capture the value of its cutting-edge AI research and development directly from customers who require these advanced capabilities. The choice between bundling AI features into existing packages or offering them as standalone products often depends on several factors, including the nature of the AI technology, the companys market positioning, and customer demand. While bundling can increase the perceived value of a product and boost customer retention, standalone products allow companies to monetize highly specialized AI technologies more effectively. Both strategies have their merits and can be successful depending on the circumstances. However, as AI technology continues to evolve and permeate various sectors, companies might need to adopt flexible pricing strategies that can accommodate both bundled and standalone offerings. This adaptability will be crucial in maximizing the monetization potential of AI features while meeting the diverse needs of customers. In the dynamic realm of AI integration, strategic decision-making regarding monetization becomes pivotal. Companies must navigate through complex considerations to devise effective strategies that not only cover costs but also maximize value to both the business and its customers. To aid in this critical process, a structured framework can be employed, focusing on key factors such as customer value, cost structures, and the competitive landscape. Firstly, understanding and quantifying customer value is essential. This involves identifying the benefits that AI features bring to users, whether by enhancing productivity, providing new capabilities, or improving user experience. Companies need to engage with their customers to gauge how much value these AI enhancements add to their daily operations or personal use. Surveys, user feedback, and beta testing can provide invaluable insights into how customers perceive the value of AI features. Secondly, a thorough analysis of cost structures associated with AI must be conducted. This includes direct costs like development, computation, and maintenance, as well as indirect costs such as training and support. Understanding these costs is crucial not just for pricing strategies but also for determining the feasibility of different monetization approaches. For instance, if the ongoing costs are high, direct monetization might be necessary to ensure a sustainable model. Thirdly, the competitive landscape must be examined. This involves analyzing how competitors are integrating and monetizing AI features. Are they bundling AI into existing products, or offering them as premium add-ons? Understanding the competitive context can help in positioning ones AI features distinctively, ensuring they stand out in the market and attract users. With these factors in mind, companies can move to a step-by-step decision-making process for choosing between direct and indirect monetization: **Step One: Evaluate AI Feature Impact** - Assess the impact of the AI feature on the core product or service. If the feature significantly enhances the core offerings, indirect monetization through bundling might be more suitable as it can increase the overall product value and user retention. **Step Two: Cost Analysis** - Conduct a detailed cost analysis. If the AI feature incurs high variable costs, direct monetization could be necessary to recover these expenses effectively. **Step Three: Competitive Analysis** - Review how similar features are monetized by competitors. If direct monetization is the norm for high-value AI features in the market, it might be wise to follow suit to avoid underpricing valuable technology. **Step Four: Customer Value Assessment** - Determine the customers willingness to pay for the AI feature. If the feature is highly valued and unique, direct monetization could be feasible. Conversely, if the value perception is lower, bundling the feature might drive broader adoption and benefit from scale. **Step Five: Long-Term Strategic Fit** - Consider the long-term implications of the chosen monetization strategy on brand positioning and customer relationships. Ensure that the strategy aligns with the company’s overall goals and market positioning. By systematically addressing these steps, companies can make informed decisions on how best to monetize their AI features, balancing immediate financial returns with long-term strategic goals. This nuanced approach allows for flexibility and adaptability in an ever-evolving market, ensuring that AI monetization strategies remain robust and responsive to changes in technology and user expectations.